Financial Statement Second Course Review

GET TO KNOW

GET TO KNOW

RESTAURANT TAX PRACTICE PARTNER

OUR RESTAURANT FINANCIAL STATEMENT SECOND COURSE REVIEW

We know the importance of having a full menu of restaurant back-office and bookkeeping services. That is why we have partnered with Bookkeeping Chef, a cloud-based managed bookkeeping services company in downtown NYC.

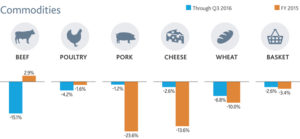

From commodity price changes affecting food costs, to new IRS regulations to labor cost increases to Affordable Care Act, to properly reporting the increase in commercial rents, the New York City restaurant industry must account for the cost and impact of numerous new changes and profit margin challenges.

Aber CPA’s restaurant accounting tax practice offers a “Second Course” Financial Statement and previously filed tax return reviews at no initial upfront charge. Sometimes your restaurant business could benefit from a second professional opinion to identify mistakes and missed deduction opportunities.

Schedule a free consultation today!

Whether you are wondering if your tax return is missing valuable tax deduction opportunities or seeking peace of mind by assuring your company’s financial statements are accurate and in GAAP compliance, it pays to get a second look.

Aber CPA’s Restaurant Tax & Accounting Practice offers a “Second Course” review services, which give your business an unbiased double-check on some of your company’s most important financial documents (P&L, Cash Flow Statements, Income Statement, Balance Sheet) — with no pressure or obligation to switch CPA firms immediately.

“I have saved clients up to $200,000 in one year.” Scott Aber founder of Aber CPA

SERVICE OFFERINGS

Prior Year Tax Return Savings Evaluation

Aber CPA offers prospective clients a complimentary review of your company’s prior federal and state income tax returns with recommendations for potential tax savings opportunities that may have been overlooked.

Aber CPA offers prospective clients a complimentary review of your company’s prior federal and state income tax returns with recommendations for potential tax savings opportunities that may have been overlooked.

With over 20 years of industry experience, Aber CPA has a pretty high success rate of finding restaurant-specific tax saving opportunities that other New York CPAs may miss. From incorrect, tax depreciation lives to omission of restaurant-specific federal tax credits. Many of these potential tax finding opportunities can be corrected through amended tax returns–resulting in an immediate benefit in the form of refunds of taxes your company previously paid.

Aber CPA will review your returns and discuss the results with you. You will receive a summarized report with possible recommendations that can be shared with others in your organization and with your outside consultants. AberCPA always stays current on the new State and Federal tax laws and can work closely with your business to evaluate your specific situation and create unique tax savings strategies to minimize your tax liability today and in the future. Join some of our satified clients.

Technical Review of Financial Statements

Receive a complimentary ($300 value) technical review of your financial statements and a report of our findings. Our professionals will look for potential errors or omissions in your financial statements and provide recommendations that could provide cost savings for your hospitality business.

We will discuss the results with you and provide a report, which will include:

- Matters requiring further information

- Possible errors with a financial statement impact

- Missing disclosures required by GAAP

- Formatting and other changes to note

- Financial statement presentations to consider changing (e.g., Statement of Operations Presentation)

OUR COMPREHENSIVE TAX PLANNING & COMPLIANCE CAPABILITIES INCLUDE:

- Account and Interest Recovery Services

- Accounting for Income Tax

- Amended Tax Returns

- S-Corporations

- Business Tax Consulting

- C-Corporations

- Limited Liability

- Accounting for Uncertainties in Tax Positions

- Accounting Methods

- Corporate/Federal Taxation

- Cost Segregation

- NOL Carryforward Analysis

- Outsourced Accounting Services

- Pass-through Taxation

- State and Local Taxation

ABOUT ABER CPA RESTAURANT ACCOUNTING TAX PRACTICE

Aber CPA is one of the very few CPA firms in the NYC with a robust and dedicated restaurant hospitality practice. Aber CPA has served hundreds of clients across New York Tri-state metropolitan area the ranging from small startup independents to larger established national chains, from quick-serve locations to fine dining establishments, and from fast casual to emerging chains. We draw on 20 plus years of extensive knowledge of corporate accounting and taxation best practices in order to help our clients drive profitability and growth. In addition to a full menu of tax and Accounting services, our also provide a wide range of business advisory services, including internal control reviews, menu engineering to cash flow analysis.