- (845) 215-5969

- Schedule an Appointment

- New Portal Login

Law firm Accounting & tax services in NYC

Scott M. Aber CPA is experienced in providing accounting, bookkeeping and tax services to law firms and sole proprietors in the New York City & Rockland County, NY area.

LeanLaw Accounting Integration Pros

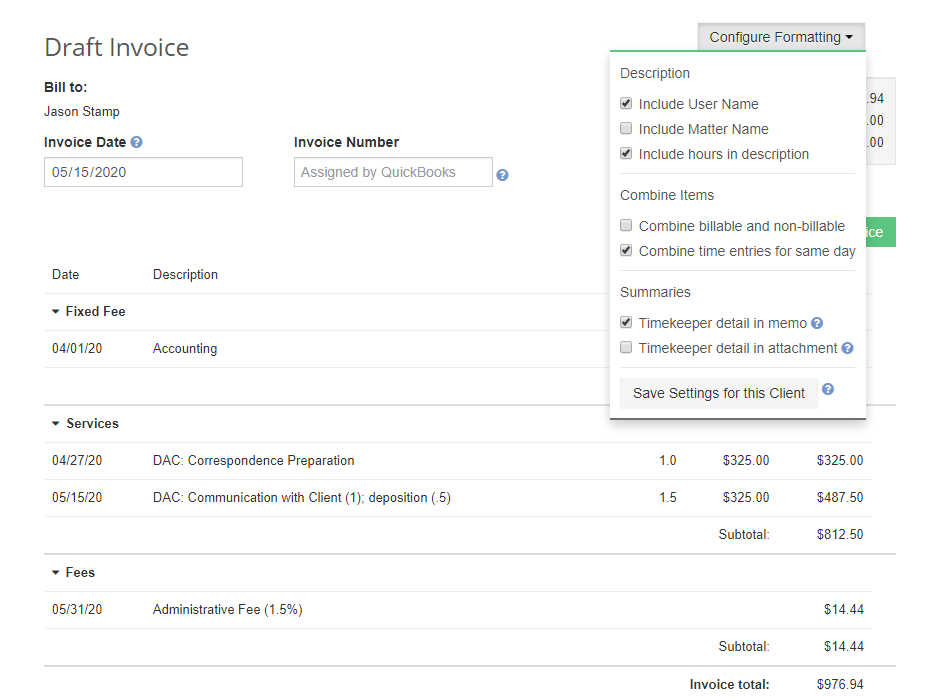

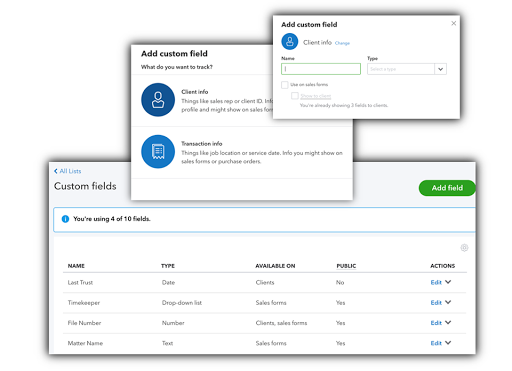

Law firms must follow specific accounting rules set out by their Bar Associations. Make legal trust deposits and pay invoices from trust using LeanLaw. What used to be a daunting 12-step trust accounting process in QuickBooks Online is now one click. Automate Billing using software that integrates seamlessly with LeanLaw timekeeping. Automate this crucial legal billing workflow and send invoices to clients in a timely manner. Use the time Tracker app to never miss adding billable hours.

Accounting Solutions to Help Law Firms Grow

In today’s digital, client-centric economy, law firms face significant challenges. To navigate these challenges, firms need a trusted advisor who understands how to turn these challenges into advantages with issues like strategic planning, consolidation, tax planning, cost management, pricing and profitability. Making sure your billings are up to date. Precise, on-time accounting is essential in today’s fast-paced business environment.

Impact of Tax Reform Changes

With the passage of The Tax Cuts and Jobs Act of 2017, —many law firms are still trying figure out how the new legislation is impacting their firm and partners, as well as evaluating how they can best position their firm for the future.

Back office accounting services you can trust

Scott M. Aber, CPA are experts in providing law firm accounting services. They maintain a prestigious emphasis in consulting, tax, and accounting services to all types of law professionals.

Law firms have distinct accounting requirements and keeping up with these transactions can be challenging. Scott M. Aber, CPA is a confident professional of all tax services in the New York Tri-State area and we have served hundreds of law firms, ranging in size from smaller two-partner practices to larger firms with multiple partners.

About Us

Scott M. Aber, CPA is a graduate from New York University (NYU) and has years of experience, skills and expert knowledge. Scott is always ahead of the the game because he stays update to date with the changing tax laws and will always be one step ahead in being able recognize any challenges that have a financial impact on your law practice.

In other words we help many lawyers each year, so we know what strategies work and what do not. Our NYC CPA firm can handle everything from bookkeeping and financial statements to tax returns and tax planning strategies.

Law Office Management

Some of the most valuable assets that a law office its administrative team. The Administrative team does not just field phone calls. Let’s take a look at what what essential services these professionals provide:

- Associate and staff compensation levels including trust accounts

- Employee retention issues including billable hours

- Lawyers’ trust accounts

Cash Flow Analyses

Cash is king rendering the focus on cash flow analysis so important. For a CPA, this is his or her language. If possible, see what your competitor’s books indicate (these can usually be found through town hall, ironically) and see where your business stand in comparison.

One common service provided by CPAs is cash flow analysis. Your opponent’s cash flows can be analyzed to determine the best settlement option that will maximize recovery for your client while minimizing the strain on the opponent – ensuring your client has the best chance to make a full recovery. Your CPA can help you with cash concerns; usually it is just a matter of reviewing typical procedures and ensuring you have adequate control over your cash receipts.

Areas of Expertise

Business and Asset Valuations

If you are planning on exiting a business venture, the first thing you need to know if the actual value of the business which can, for the most part, be located via asset value or liquidation.

Tax Planning & Review

The tax consultants at Scott M. Aber CPA are well versed in the latest tax regulations and how they can affect your legal practice. We offer strategic tax planning solutions that will ensure that will minimize your tax liability .

Outsourced Bookkeeping

Many law firms outsource their bookkeeping to a well-meaning legal assistant. However, with detailed IOLA and trust account reporting regulations and unique billing requirements, your consistent growth and compliance depends upon having an experienced certified public accountant with industry expertise to oversee your finances..

Monthly Financial Reporting

Get monthly statements that are easy to understand and include the numbers that matter, like your P&L and expenses. Our software auto–categorizes and identifies errors, while your financial expert reviews and tailors every set of books. The result? Monthly reports with unmatched accuracy..

Accounting for NY law firms, made simple

We provide a myriad of financial management solutions that include accounting, tax, bookkeeping, and consulting services. Some of the specialized services we offer attorneys that can be customized to suit the needs of your particular practice,

- Accounting for real estate transactions (i.e., proceeds and escrow deposits);

- Paperless, automated accounts payable processing; and Payroll solutions.

- Guidance, access & support for accounting technology and systems

- Outsourced CFO/controllership

Schedule an appointment today!

© Scott M. Aber, CPA, PC