- (845) 215-5969

- Schedule an Appointment

- New Portal Login

ACCOUNTING, FINANCE, TAX & HR FOR New York STARTUP Businesses

Starting and managing a small business is rough in any location, but operating in New York City is challenging. With the assistance of our tax & accounting professionals, your business can survive and thrive.

Tackling small business painpoints

NY Businesses face unique accounting challenges

The NYC Tri-State area is a global hub for commerce and business. These are are the precise reasons why a Manhattan Certified Public Accountant (CPA) is an absolute necessity.

I am proud to serve clients in the New York City area and offer a variety of consulting, financial advisory and accounting options. We don’t discriminate for purposes of our client base; we enjoy working and collaborating with startups, small businesses, medium-sized corporations or established enterprises.

30+ Years of professional accounting Expertise

to over 600 individual clients and over 150 businesses.

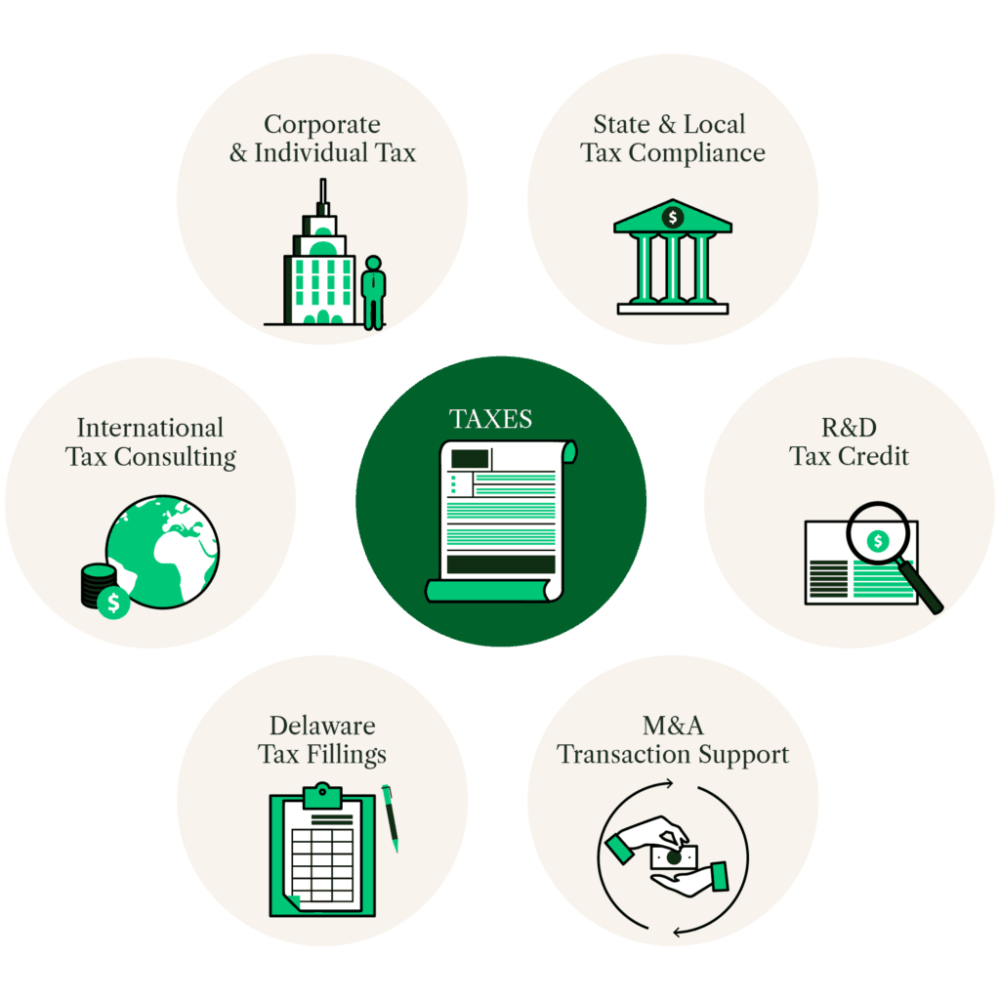

For all your tax needs, our team is here to get you on the right track

The recently enacted tax reform act combined with constantly changing accounting /GAAP laws, subsequent Treasury Department guidance and potential legislative technical corrections, makes for an unforgiving landscape when it comes to business accounting tax strategies. Did you know the corporate structure of your business matters (LLC, Partnership, C-Corp, or S-Corp)? Whether it’s an 1120S, 1120 or 1065, Scott M. Aber CPA will file the right return for you, right on time.

Tax laws in the US are complex, and staying in compliance is an area where you need an expert to guide you. And we know it’s more than just income tax. Whether it’s income taxes, payroll taxes, sales taxes, or Delaware Franchise Tax filings, a business can find themselves drowning in different filings and payments.

And if you fall out of compliance with a late filing, you can miss opportunities, or even worse, get fined for amounts that are far greater than the actual taxes.

You need a tax professional who understands the complexities of your company’s taxes. We can take it all off your plate so you focus on your primary business goals… revenue, customers, people.

We'll help you plan, file, and manage your corporate and individual taxes and stay compliant with frequently changing tax laws.

We strive for excellence and expect nothing but superior client service from our team members.

Call us at (845) 215-5969 to speak to a certified public accountant or schedule a free 30 minute consultation.

Company Capabilities

- Financial Statement Preparation: Reviews and Compilations

- Income Tax Preparation and Compliance (International, Federal, State and Local)

- Income Tax Planning and Consulting (International, Federal, State and Local)

- Budgeting and Forecasting

- Monthly, Quarterly, and Yearly Financial Reporting

- Cash Flow, Income Statement and Balance Sheet Reporting

- Implementation of Accounting Software

- Accounts Payable/Accounts Receivable

- Business Management/General Business Consulting

- Payroll (Including FICA) and Sales Tax Review

- Accounting/Bookkeeping Assistance

- General Ledger Review and Development/ Account Reconciliations

- Financial Assessment Reports

- Business Startup Consulting

- Fixed Asset Reviews

- Employee Benefits Consulting and Associated Tax Planning

- Due Diligence Procedure Monitoring

Pension/Benefit Planning

- Designing and Implement Group Benefits

- Strategies to Maximize Owner Contributions

- 401(k) and Pension Solutions

Corporation Succession Planning

- Plan Creation which Considers Current and Future Generations

- Exit strategies for outside sale

- Generational ownership transition planning

Valuation Services

- Buy/Sell Agreements/Mergers & Acquisitions

- Transfer/Sales of Business

- Capital Sourcing

We Integrate with the Best Software

We sync up with your other accounts to save time,

improve accuracy, and keep your books up to date at all times.

improve accuracy, and keep your books up to date at all times.

Accounting and tax services for businesses

A high-level view of our services follows:

Our primary goal is to make sure that your business is profitable and

prosperous because you can wholeheartedly rely on my insightful recommendations.

Federal, State And Local Filings - Payroll, Income & Sales Taxes

Well versed with filing and tracking income taxes, sales taxes and payroll figures for all 50 states.

Tax Planning

We diligently follow the constant changes in tax laws whether these changes are in regards to the methodologies for subchapter S election or new techniques to defer income. We are on top every change in the tax code, no matter how small.

Accounting & System Setup

We will assist you in organizing your finances and find the right software system that will simplify the maintenance of your financial records and bookkeeping needs. We will help develop your accounting system, maintain your accounting system and make sure it is an easy tool to use when you need to produce reports or just gather information.

Business Projections & Planning

At Scott M. Aber, CPA, I am not just your typical accountants. I also specialize in financial and business planning as well as forecasting. I will help you develop a program that allows you to achieve your financial goals.

IRS Problem Resolution

Negotiating and communicating with the IRS is something we will do on your behalf. I will guarantee that you get the best possible arrangement in a settlement with any government agency.

Aber CPA serves other businesses including:

Restaurants

Scott M. Aber, CPA is one of very few CPA firms in the New York City with a robust and dedicated Restaurant Practice.

Bars and Nightclubs

Scott M. Aber, CPA has been providing Accounting & Tax Consulting for NYC’s hospitality industry for the Past 30 years

Attorneys and Small Law Firms

In the face of intense competition, successful law firms must deliver quality legal services and practice effective business management.

Doctors and Medical professionals

With over 30 years of providing tax and accounting services to medical professionals, Scott M. Aber, CPA firmly grasps the unique needs of all medical professionals and their respective overall situations and policies.

Dental practices

Choosing the right accounting firm and CPA for your dental practice is a primary way to foster the growth of your business and its future development prospects

Real Estate Professionals

Innovative tax & financial solutions for realtors, developers, owners, investors and property managers.

Small business owners trust Scott M. Aber CPA to save time, money, and stress.

Call us at (845) 215-5969 to speak to a certified public accountant or schedule a free 30 minute consultation.

© Scott M. Aber, CPA, PC