Why Choose Us

Financial Tax Planning for

NYC Hospitality Businesses

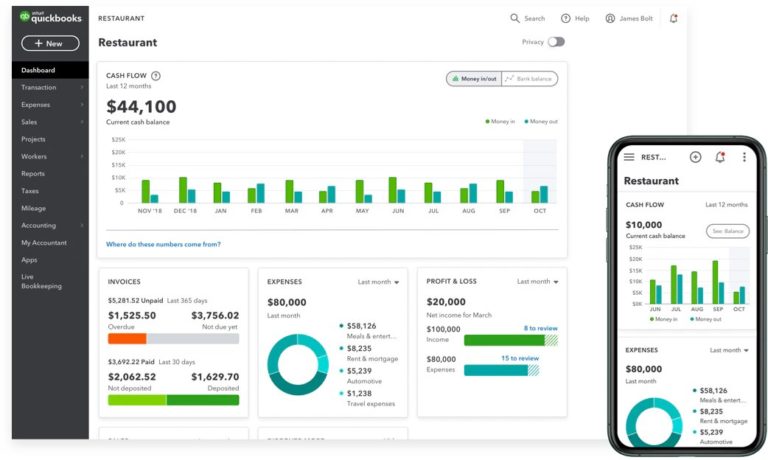

If you're a New York City restaurant owner, you know the overwhelming nature of your industry. Most eateries are open seven days a week, with grueling and unpredictable schedules for owners and employees alike — and let's not forget the demanding NYC atmosphere.

This makes proper accounting extremely difficult to manage on your own. Increase your bottom line and profits, while saving money, by working with the Aber team — experts in the restaurant industry for over 30 years.

We work with restaurants nationwide and provide our expertise to over 120 dining establishments — from franchisors, franchisees, public companies, and independents to owner-operated delis and fine dining restaurants. We serve all segments: quick service (QSR), fast casual, casual dining, pizza, fine dining, and emerging chains.

"Aber CPA has been a trusted partner that has delivered substantial value and tax savings for many years, while sharing their financial business advice. They are also able to understand and successfully respond to Danji's sales & liquor tax issues."

Hooni Kim

Owner & Chef at Danji