- (845) 215-5969

- Schedule an Appointment

- New Portal Login

Manhattan & New York Restaurant Accounting

We help restaurants manage the books, cash flow, and save money on taxes

Financial Tax Planning For NYC Hospitality Businesses

If you are a New York City restaurant owner, you are aware of the overwhelming nature of your industry. Most eateries are open seven days a week, so business owners and their employees have grueling and unpredictable schedules; and let’s not forget the demanding NYC atmosphere in which they operate. This makes the added hassle of the need for proper accounting extremely difficult to satisfy. Increase your bottom line and profits, while saving money, by working with Scott M. Aber, CPA who has the expert knowledge of the restaurant industry.

AberCPA is one of very few CPA firms in the New York City with a robust and dedicated Restaurant accounting practice. We have been offering accounting, consulting and financial planning services to clientele for 30 years. We work with restaurants nationwide, and provide our expertise to over 120 dining establishments–from franchisors, franchisees, public companies, and independents; to owner operated delis and fine dining restaurants.

We also serve all segments: quick service (QSR), fast casual, casual dining, pizza, fine dining, and emerging chains. From sales tax audits to menu engineering to capital structure, our professionals draw on extensive knowledge of best practices in order to help our clients drive profitability and growth.

Some typical barriers for a restaurant to succeed?

- Sales Tax Audits– how to protect yourself from a New York State Sales Tax Audit?

- IRS Intervention– how to avoid a tax audit and adhere to tax laws?

- Department of Labor– are you compliant with mandates and laws?

- Tipped Employees– how to track unpredictable figures and payroll costs?

- Are you taking advantage of the FICA tip credit?

- Are you correctly reporting tips to the IRS?

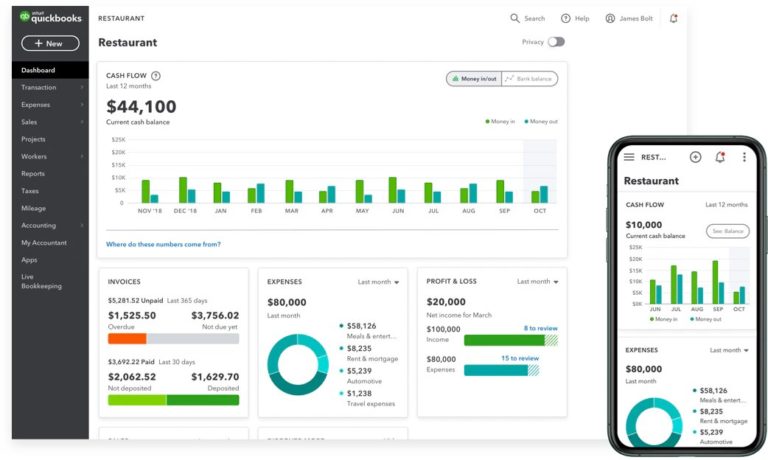

- Reliable Software for Efficient Bookkeeping– how to utilize QuickBooks effectively in your restaurant?

Testimonial

“Aber CPA has been a trusted partner that has delivered substantial value and tax savings for many years, while sharing their financial business advice. They are also able to understand and successfully respond to Danji’s sales & liquor tax issues.”

Hooni Kim

Owner & Chef at Danji

NYC’s number #1 Eatery Restaurant CPA

The statistics for maintaining a successful eatery food business are not in favor of the industry, as we witness 27% of restaurants failing in their first year, 50% failing in year number five and 70% out of business by the ten-year mark. At Scott M. Aber, CPA, we strive for absolute excellence and want your restaurant to succeed in the long run. Whether you are a diner, a family-run restaurant or a national franchise chain see why our other NYC hospitality industry clients have put their trust in us.

We know all restaurants are not the same, that is why Scott M. Aber, CPA has the tax law experience to handle each type of business. Book a 30 consultation call with a certified public accountant today.

How We Can Help Your Manhattan Restaurant Save Money :

- Monthly Financial Statement Preparation

- Federal and State Income Tax Planning

- Start-up Business Assistance

- Preparation of Business Plans

- Accounting System Setup

- Point-of-Sale (POS) Systems

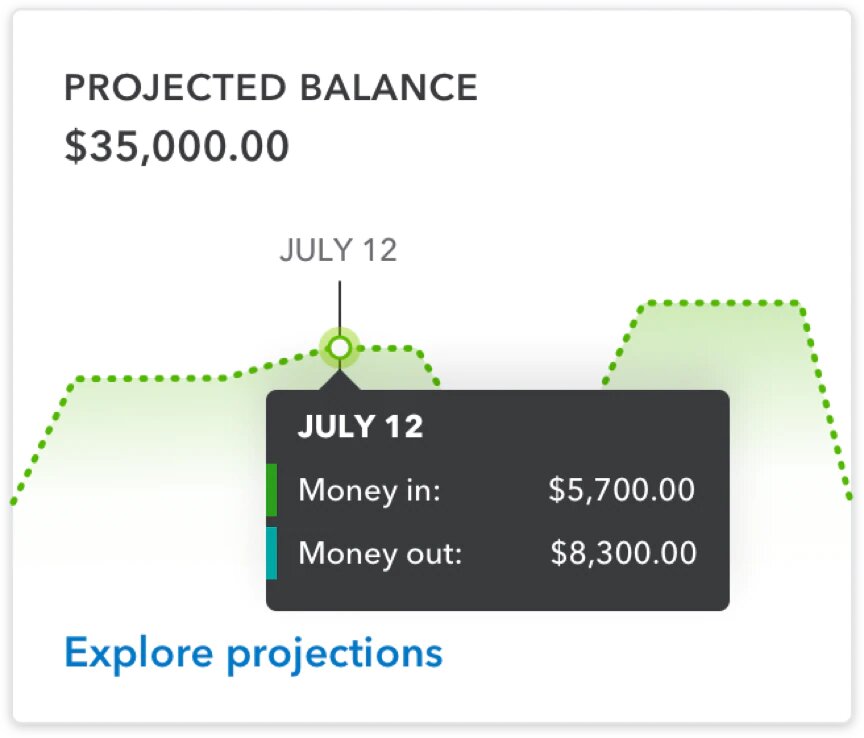

- Forecasts, Projections and Succession Planning

- Bookkeeping Services

- Bill Payment systems

- Payroll Services

Your Restaurant's online bookkeeping and tax team

We take the stress out of bookkeeping and accounting for your eatery, helping to run the back-office remotely, next door.

Get started today with a free consultation.

I have saved clients up to $200,000 in one year.

OUTSOURCED ACCOUNTING FOR Restaurants

A high-level view of our services follows:

We can Manage costs to stay on budget

A restaurant’s bottom line is heavily reliant on cash. Whether it’s from a NYC restaurant, a coffee shop, a dinner or a food truck, we help to manage your cash flow, track income and expenses. Collect, report and pay sales tax faster.

Automate bill and invoice approvals

We help restaurants streamline back office processes. Automate your accounting system by using customized workflow templates to streamline repetitive billing and invoicing tasks. We help restaurants automate and run AP and AR remotely leveraging smart technologies such as Expensify or Bill.com.

Profit & Loss reports actionable insights

Restaurants run on tight margins. Understand how changes to your menu or operations impact your bottom line. Weekly profit and loss reports, help to analyze performance, and make adjustments when needed.

Managing Accounting Cycles

Restaurants accounting cycles usually start when a customer orders a meal and end when the meal is purchased and recorded in the restaurant’s general ledger or accounting system. Because your restaurant ideally has more than one customer each day- dozens of ledger journal entries need to be documented daily. We streamline this process by assisting in the development of an accounting system for journal entries and subsequent financial reporting.

Setup Inventory Tracking

Inventory is a cost to your restaurant, but absolutely essential as it consists of food, beverage, and other miscellaneous items. At the same time, restaurants do not want to order too much…or too little. We help you to determine the perfect balance, thereby reducing your costs and the overall profitability of your restaurant.

Trusted By Premier NYC Eatery Establishments

“Scott has been my accountant for my restaurants for the last 15 years in all those years and I’ve yet to have any real issues with the IRS . He knows the laws well and really guides you through the complexities and ever-changing laws in this business. He always goes above and beyond and makes himself available for my many random questions. I have recommended countless people and everybody’s been very happy with his work . I highly recommend him”

Darin Rubell

Serial Restaurateur Rubell Group

Let BookKeeping Chefs Manage Your Restaurant’s Books

We are proud to introduce Bookkeeping Chefs, a cloud based bookkeeping management software solution designed to give New York City Restaurants 24/7 access to their cash flow and critical financial data which compliments our restaurant tax accounting services.

Need help preparing your 2021 tax filing?

Rest assured, we can help prepare New York City hospitality restaurant for the upcoming tax 2021 filing year and will make sure you get every dollar your business deserves.

© Scott M. Aber, CPA, PC