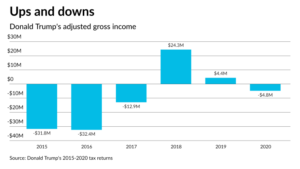

Key takeaways from Trump’s tax returns

Massive losses and large tax deductions in Donald Trump’s returns reveal how the former president was able to use the Tax Code to minimize his income tax payments. Democrats on the House Ways and Means Committee released Trump’s tax returns Friday, after he lost a multi-year legal battle to keep