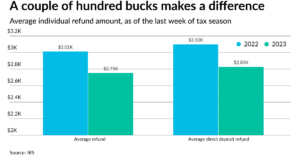

Tax season by the numbers: 2023

The verdict for this year’s tax season is that it was one of the most normal in years, without any of the craziness of the first three season of the COVID pandemic, or the massive tax law changes of the few years before that — and that’s all reflected in