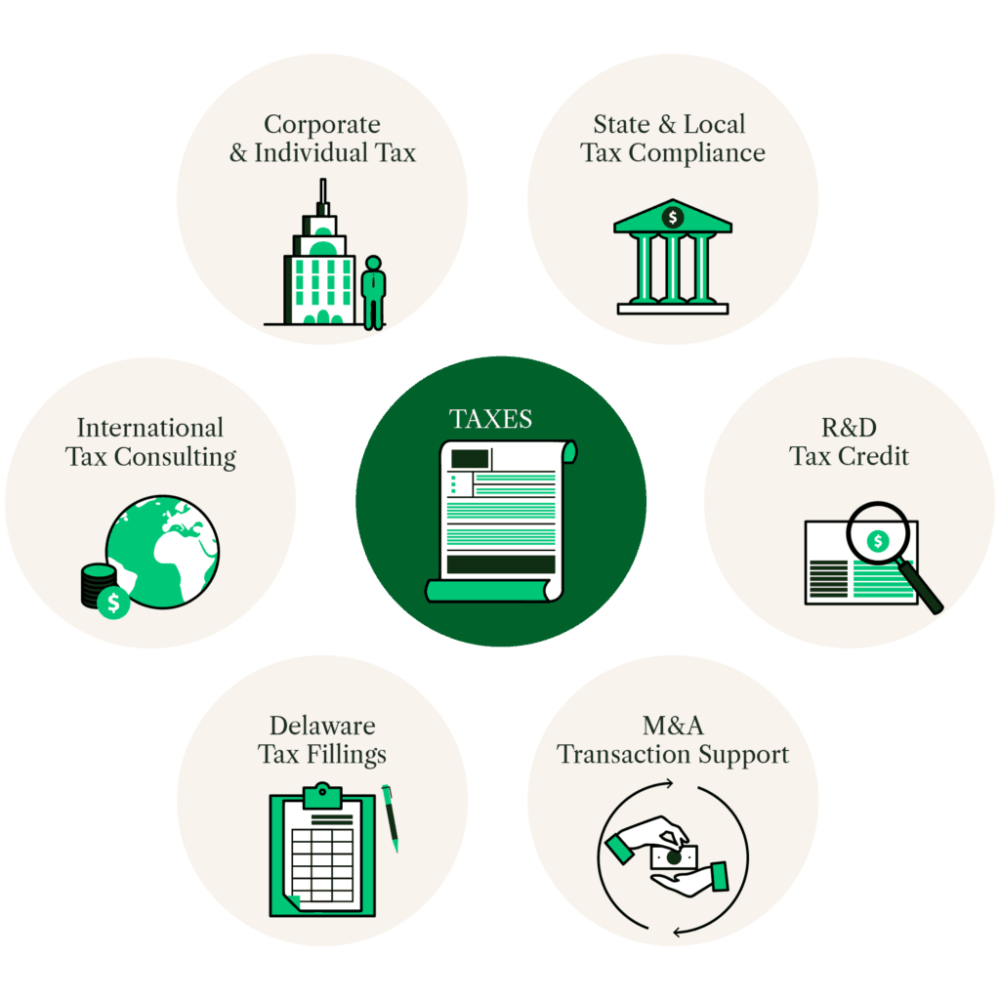

For all your tax needs, our team is here to get you on the right track

The recently enacted tax reform act combined with constantly changing accounting /GAAP laws, subsequent Treasury Department guidance and potential legislative technical corrections, makes for an unforgiving landscape when it comes to business accounting tax strategies. Did you know the corporate structure of your business matters (LLC, Partnership, C-Corp, or S-Corp)? Whether it’s an 1120S, 1120 or 1065, Scott M. Aber CPA will file the right return for you, right on time.

Tax laws in the US are complex, and staying in compliance is an area where you need an expert to guide you. And we know it’s more than just income tax. Whether it’s income taxes, payroll taxes, sales taxes, or Delaware Franchise Tax filings, a business can find themselves drowning in different filings and payments.

And if you fall out of compliance with a late filing, you can miss opportunities, or even worse, get fined for amounts that are far greater than the actual taxes.

You need a tax professional who understands the complexities of your company’s taxes. We can take it all off your plate so you focus on your primary business goals… revenue, customers, people.