IOLA without drama

Three-way reconciliation, monthly. Bank ↔ trust ↔ client ledgers. No negative balances. No commingling. Signed off and archived.

- Monthly three-way recs

- Exception reports and fixes

- Audit-ready trails

Your IOLA reconciliations shouldn't require more attention than your opening arguments. After 30+ years keeping NYC law firms compliant and profitable, we speak fluent legalese—trust accounting, partner draws, Bar requirements—so you can focus on what you bill for.

Most CPAs break into a cold sweat at "three-way trust reconciliation." Not us.

We've navigated hundreds of firms through the peculiar maze of legal accounting—where client funds mingle with operating accounts about as well as opposing counsel at depositions. One mishandled retainer, one sloppy trust transfer, one confused Bar examiner, and suddenly you're the case study, not the counsel.

Three-way reconciliations so clean, Bar examiners won't have questions. Audit-ready records that make compliance reviews surprisingly pleasant.

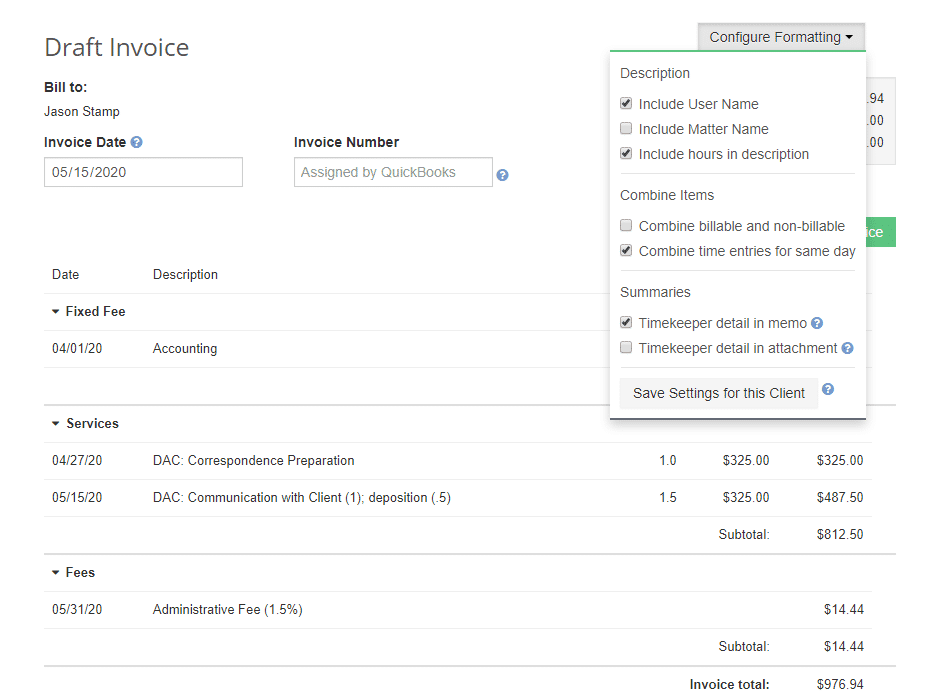

LeanLaw, QuickBooks Online, whatever you're running—we make it talk to your books fluently. Less time chasing invoices, more time billing hours.

P&Ls that tell the real story: which practice areas profit, which partners produce, which expenses need interrogation. Automated accuracy with human insight.

Federal, state, city—we handle the trifecta. Strategic planning that treats partner distributions like the tax events they are, not the surprises they shouldn't be.

Classifications clear enough to satisfy the DOL's finest. Because "of counsel" means something specific to more than just your letterhead.

Financial counsel for growth, succession, and partner planning. From cash flow analysis to practice valuations—the numbers that shape your firm's future.

Through boom markets, bust cycles, and every Bar requirement revision

From fresh bar admissions to established institutions

We make LeanLaw and your billing platform play nicely with actual accounting

30 minutes to examine your books like we'd examine a witness (thoroughly but respectfully)

Transparent as required disclosure, fixed as a signed retainer

We handle the heavy lifting while you handle the motions

Join hundreds of law firms we've helped since the '90s

Real outcomes: clean IOLA reconciliations, audit-ready records, and billing that actually bills.

Let’s make it a 20-minute answer. We’ll show you exactly where you’re exposed — and how to fix it before auditors care.

Free IOLA Compliance Review →Beyond “keeping the books” — we run the controls, the billing engine, and the numbers partners use to run the firm.

Three-way reconciliation, monthly. Bank ↔ trust ↔ client ledgers. No negative balances. No commingling. Signed off and archived.

LeanLaw + QuickBooks workflows that turn time entries into invoices into collected cash. Fewer write-downs, faster cycles.

Not just a P&L. Partner draws, practice profitability, and runway. Clear answers to “can we hire?” and “what should we do next?”

Law firms must follow specific accounting rules set out by their Bar Associations. Make legal trust deposits and pay invoices from trust using LeanLaw.

QuickBooks integration with one-click trust accounting.

Led by NYU-trained CPAs with decades serving New York law firms, the Aber team has built its reputation on staying ahead of tax law changes and trust-accounting rules. That foresight has protected hundreds of lawyers from costly mistakes — and freed them to focus on cases, not compliance.

Our practice combines technical depth with practical responsiveness. Whether it’s reconciling IOLA accounts, navigating partner draws, or planning for growth, you get senior-level attention and fast answers from people who know law-firm accounting inside out.

Two paths forward: a quick check on exposure, or a full transition plan. Either way, you’ll know exactly where you stand.

For firms tired of financial anxiety© Scott M. Aber, CPA, PC