Top Data Security Practices to Protect Your Firm

As cybercriminals ramp up the volume of attacks in the financial services sector, accounting firms are not immune. Below are several key steps your firm

The latest information from our Accountants

As cybercriminals ramp up the volume of attacks in the financial services sector, accounting firms are not immune. Below are several key steps your firm

As a tax preparer, the primary issue to avoid down the road is whether you were “unreasonable” on a day you signed a return.

Rep. Don Beyer, D-Virginia, introduced a bill to impose a 1,000% excise tax on manufacturers, importers or producers of assault weapons and high-capacity magazines in

By taking stock of your client’s property’s individual assets, cost segregation speeds up depreciation so they can deduct more from their taxes. Through this article,

With National Small Business Week over, now is a good time to look at how business owners appear on their personal tax returns, suggests tax

As you start thinking about next tax season, consider this: A timely client conversation could change the trajectory of your year and your firm. We’re

Every June, people around the world celebrate the LGBTQIA+ community and actively recognize the challenges, from the personal to the financial, as well as the

The Financial Accounting Standards Board is asking its stakeholders to provide feedback on whether it should work on a new standard to account for government

It’s prime conference season–and for many of us, it’s vacation season, too. As exciting and energizing as it is to attend a professional conference or

Tipalti, a software company that specializes in accounts payable and global partner payments workflows, announced new features to its accounts payable automation solution that enhance

Top executives are having trouble keeping up with an ever-growing array of risks, as surging inflation, supply chain constraints and the war in Ukraine add

The Internal Revenue Service gave out far less money last year to tax whistleblowers than in recent years and collected much less as well, according

Deloitte is denying a report this week that it plans to spin off its audit practice as a separate entity from its consulting practice as

With available proposal management software, accounting firms can leverage artificial intelligence (AI) and automation tools to accelerate their digital transformation plans. Through this cloud-based software,

As many accounting professionals know, innovation in business often trails innovation in the consumer experience. Businesses typically make changes based on consumers’ expectations, but accountants

As expenses like energy and groceries continue to rise at double-digit annual rates in the United States, some investors might be wondering whether cryptocurrency can

Amicable crooks; a load of kibble; what a stool; and other highlights of recent tax cases. Atlanta: Reality TV stars Todd and Julie Chrisley have

As the leader of your firm, you can probably relate: When it comes to issues at your practice, two of the biggest challenges are interpersonal

While much has been said about the benefits of automation, small-firm practitioners may feel such things are out of their budget. But according to Brian

Our partial gift focus herein, which tends to be relatively simple, involves transferring an interest in a residence to a qualified charity after you pass,

When people talk about artificial intelligence, what they’re really talking about is the ecosystem of different technologies — like machine learning and natural language processing

Bridge loans are a popular way for startups to ensure they have enough cash. Here’s what you and your clients should know about them. Startup

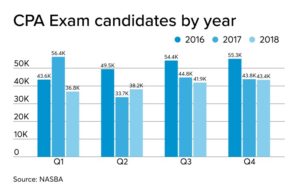

The National Association of State Boards of Accountancy, the American Institute of CPAs and Prometric announced that qualified Uniform CPA Examination candidates applying to participating jurisdictions can test at

Tax season demands so much of us, how are we supposed to set boundaries with ourselves and our clients so they respect our time? When

The Internal Revenue Service’s Employee Plans function is pilot-testing a new pre-examination retirement plan compliance program, starting this month, as a way to shorten the

The Public Company Accounting Oversight Board plans to hold a meeting next Wednesday with its reconstituted Investor Advisory Group, the first meeting in nearly four

This edition of Generational Viewpoints features two professionals from Andrea & Orendorff, a 35-person firm based in Kenosha, Wisconsin. We asked baby boomer partner Kathy

Paychex has officially launched an integration with Jirav that allows accounting firms using both technology solutions the ability to offer high-value financial planning and analyis(FP&A)

A taxpayer can benefit from an enhanced deduction by donating appreciated property to charity; however, in a recent Tax Court case, Albrech, TC Memo 2022-53,

The Financial Accounting Standards Board is making plans for its future projects, including digital assets, intangibles, government grants, and accounting for financial instruments with environmental,

© Scott M. Aber, CPA, PC