Accounting Technology Is at an Inflection Point

With apps being used more than ever in accounting, these professionals have a chance to take some control over where technology and vendor relations go.

The latest information from our Accountants

With apps being used more than ever in accounting, these professionals have a chance to take some control over where technology and vendor relations go.

IRS Collections is an enigma and a different kind of animal from the rest of the IRS. There are hard and fast deadlines that must

The International Sustainability Standards Board hopes to establish a comprehensive “global baseline” of sustainability disclosures and described some broad steps Wednesday to achieve it by

There could be a number of reasons why your business clients may want to add new members to their LLC. Perhaps they need funds and

If you’re just joining us, go back to the first three columns in this series. There, you’ll find an overview of the basics of Form 1040-X, Amended U.S.

Congress gave billions of dollars in tax credits to employers in response to the COVID-19 pandemic that helped pay for providing paid sick and family

Women in accounting and bookkeeping often don’t feel seen or heard due to bias in the workplace, but a new generation has emerged, and they’re

The International Public Sector Accounting Standards Board issued a consultation paper on natural resources on Monday to consider various issues relating to recognition, measurement and

The word “inflation” has returned to people’s vocabulary. Your client probably feels the impact when they shop for groceries; everything seems to cost more. Meanwhile,

Victims of wildfires and straight-line winds that began in New Mexico on April 5 now have until late summer to file various federal individual and

If you remember “The Spirit of Accounting,” perhaps you’re as surprised as I am to see it published again. If you don’t recall, this column

The Internal Revenue Service is coming under criticism from Congress and the American Institute of CPAs for destroying an estimated 30 million paper-filed information returns

Maximizing investments is a goal for every investor and if you want to help your clients realize a better net after-tax, these tips can help.

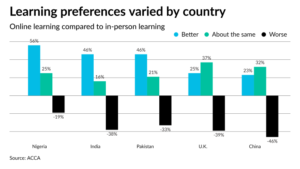

Educators aren’t fully meeting the needs of students or employers when it comes to teaching accountants and finance professionals, according to a new international analysis

If you’re just joining us, part one in this series explains the basics of Form 1040-X, Amended U.S. Individual Income Tax Return, formerly Form 1040X. It also offers

Tax resolutions aren’t for every accountant, but it can be lucrative if you know the right way to deal with them. For any tax pro,

CEOs who prefer risky sports hobbies are more likely to take a risky approach to their company’s tax planning, according to a new study published

What does it mean to be an ‘authentic’ accountant and how can this actually help your practice? In her opening keynote address at AccountingWEB Live

Accountants across America are facing the serious issue of capacity management, which has shown itself to be complicated to understand and has left practitioners struggling

A group of tax enforcement leaders from five countries, including the U.S., are collaborating on ways to investigate the use of nonfungible tokens and decentralized

The basic focus of the Section 183 hobby loss provisions is on Section 162 and its “ordinary and necessary” criteria for deducting business expenses and

The Public Company Accounting Oversight Board named the members Monday of its two new advisory groups, the Investor Advisory Group (IAG) and the Standards and

Sometimes history repeats itself. Years ago, when I was a financial advisor in Brooklyn, New York, a large number of people leaving Eastern Europe, where

Financial Accounting Standards Board chair Richard Jones said that, over the course of its agenda consultation process, stakeholders have communicated that a project to permit or

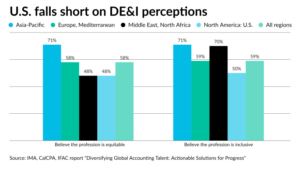

The accounting profession is undergoing a reexamination of its efforts to address the lack of diversity, not only in the U.S. but in other parts

For some of your high-net-worth clients, the financial strategy of liquidating life insurance via a life settlement comes with tax implications. Life settlement taxation is

More than 30,231 taxpayers may now qualify for Additional Child Tax Credits totaling over $16 million after the Internal Revenue Service implemented a provision of

The Internal Revenue Service is continuing to face staffing challenges that are holding back its efforts to process both last year’s and this year’s tax

As we emerge from a busy tax season, it’s clear that the dealmakers have been working hard behind the scenes to get a leg up

For the first time since 2019, Intuit’s QuickBooks Connect event is returning to the live stage but this time it is solely focused on accounting

© Scott M. Aber, CPA, PC