Optimize Your Capacity with Process Documentation

Delegating, outsourcing and automating tasks can increase your capacity at work. Whether your plate is too full or you’re looking toward starting new projects, these strategies can

The latest information from our Accountants

Delegating, outsourcing and automating tasks can increase your capacity at work. Whether your plate is too full or you’re looking toward starting new projects, these strategies can

The pandemic-era housing boom has made real estate an enticing investment prospect for many people. Accountants, in their role as investment advisors and financial planners,

Accountants go meta; muddy start to the season; the controller as preparer; and other highlights from our favorite tax bloggers. What a world Institute on

The IRS has announced that the filing season for federal individual income tax returns for 2021 kicks off on January 24 (IR-2022-08, 1/10/22). The IRS already

The vast majority of tax and finance leaders see a need for improved technology and data skills in their employees, according to a new international

QuickBooks is a blessing for a large percentage of the population, as it provides premium level accounting features to its users. Nevertheless, it has an

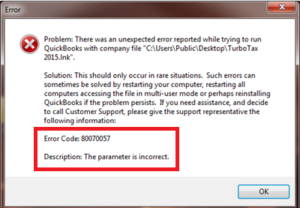

QuickBooks encounters errors while opening the company file that is quite common while running the QuickBooks Desktop application. QuickBooks requires permission to access files located

Let’s say you’re about to wrap up an initial consultation with a potential new client. The meeting flowed smoothly, you gathered all the necessary information and

The Internal Revenue Service has updated its guidance on claiming the Recovery Rebate Credit and issued a report Friday on how it responded last year

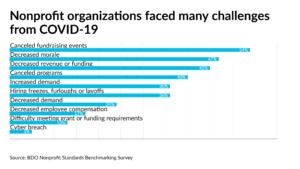

Nonprofit organizations have been growing their operating reserves over the last year, despite the pandemic, while experiencing other positive changes, according to a new survey.

With the launch of QuickBooks 2019, sick and vacation pay feature is now more reliable and delivers accurate results. However, sick and vacation time may

Businesses have faced extraordinary challenges throughout the ongoing COVID-19 public health crisis. For many organizations, abruptly moving to remote work in March 2020 forced CFOs

No doubt, QuickBooks Payroll is one of the top choices of businesses for managing accounts, because of its wide range of easy to use features.

Build Back Better, the Biden Administration’s signature social spending bill, appears in limbo in its current form. But which tax proposals should banks and financial institution’s

Change is difficult, even when it’s desired. In fact, change in the workplace can be more challenging than major traumatic life events like bereavement and

Seven digits short; Miami vice; nice going, Ace; and other highlights of recent tax cases. Cambridge, Ohio: Contractor Daniel L. Speedy has pleaded guilty to

If you are looking for a universal application that serves your accounting needs, while reducing the labor you put into maintaining your records on a

What’s a financial advisor’s greatest fear? The COVID-19 pandemic last forever? Another lockdown? A 20-percent decline in the stock market? No, it’s their client’s accountant

Start-up cost deductions are normally allowed, but as a recent Tax Court case shows, clients need to prove the business is operational. Background: Normally, a

Most of the QuickBooks Desktop errors are caused by improper setup of the application on the Windows operating system, whereas error 61 occurs when the

Parthenon Capital, a private equity firm based in Boston, has struck an agreement with Chicago-based RSM US LLP, to acquire Top Five Firm’s wealth management

QuickBooks is a vigorous accounting software that has several advanced features under its head. One of these prominent components of QB is the QBW32.exe file,

January can be a stressful month for bookkeepers. In addition to our normal workload, we have additional payroll deadlines, 1099s are due, we’re trying to

You can connect your bank account to QuickBooks to avoid the manual data entry challenges and prevent errors that can affect your accounting data due

Details: Alexander Thompson Arnold PLLC, also known as ATA CPAs, a firm based in Edison, New Jersey, has expanded to Arkansas by acquiring JWCK Ltd.,

At the recent Digital CPA conference I had the pleasure of sitting in Jennifer Wilson’s session, “Solving the Capacity Problem.” This is an issue that

The Internal Revenue Service has revised Form 1024, “Application for Recognition of Exemption Under Section 501(a) or Section 521 of the Internal Revenue Code,” to

Jonathan Curry-Edwards Jonathan Curry-Edwards was hired as a tax partner in the private client services group at Grassi, New York. Anchin, New York, promoted 11

Keep it in the black; employment shuffle; distrust; and other highlights of recent tax cases. New York: Jordan Sudberg has pleaded guilty to tax evasion

Chief tax officers are anticipating some major developments in the New Year when it comes to international taxation, mergers and acquisitions, technology, talent and more,

© Scott M. Aber, CPA, PC