10 Major Business Tax Changes in 2016

Businesses and individuals need to be aware that a large number of IRS tax law changes are going into effect this year. Many of them were created by the Protecting Americans from Tax Hikes (Path) Act of 2015, although there was legislation passed in 2015 and 2014 that also contributed a large portion of it. By learning about these changes before filing this year, you will be better prepared to make the right steps to save as much money as possible.

This article will cover the major changes that could have an effect on your business or family. This recent legislation responsible for the largest part of changed tax rules for 2016 is composed of;

- The Fixing America’s Surface Transportation (FAST) Act

- The Protecting Americans from Tax Hikes (PATH) Act of 2015

- The Bipartisan Budget Act of 2015

- The Surface Transportation and Veterans Health Care Choice Improvement Act of 2015

- The Trade Preference Extension Act of 2015

- The Achieving a Better Life Experience Act of 2014 (ABLE Act), part of the Tax Increase Prevention Act of 2014

Business and Individual tax law changes include:

1) Obamacare Affordable Care Act tax Penalties Increase: Individuals without health insurance in 2016 will be hit with higher penalties on their tax returns. The family maximum penalty will be equal to the premium cost for the national average of the Bronze Plan listed on the federal health exchange, or $2,085, which is substantially higher than $975 in 2015. You must obtain a plan or be covered under one in the first 2 months of 2016 to avoid this penalty.

2) Deductions, Exemptions and Tax Breaks: In 2016, the personal exemption is estimated to be $4,050, which is only $50 more than in 2015. However, for high-income earners, this deduction has been taken away. At the same time, the head of the household standard deduction has increased a bit. Also worth noting, the tax brackets that help you understand how much you owe and which bracket you are in, are tied to inflation. So for 2016, the brackets are projected to increase by approximately 0.4 percent.

3) The Exemption from AMT is Now Higher: Everyone’s favorite alternative minimum tax has affected a large number of taxpayers, which now makes the exemption even more important. Single filing taxpayers will see their AMT increase by $300 in 2016 to $53,900, while married joint filers will see a $500 boost to $83,800.

4) Extension and modification of R&D Tax credit: The provision permanently extends the research and development (R&D) tax credit. Additionally, beginning in 2016 eligible small businesses ($50 million or less in gross receipts) may claim the credit against 3 alternative minimum tax (AMT) liability, and the $250,000 credit can be utilized by certain small businesses against the employer’s payroll tax (i.e., FICA) liability.

5) Health Savings Account Changes: Health savings accounts let people with high-deductible health plans set money aside on a pretax basis to cover the costs of their health care. If you have a family and a Health Savings Account (HSA), you now are allowed to contribute an additional $100 in 2016 to a maximum of $6,750. For individual filers nothing changes and your allowable contribution amount will remain at $3,350.

6) Earned Income Credit Goes Up: The maximum tax credit you can earn under the Earned Income Credit is going up slightly. If you have a family and 3 children, your maximum credit will increase by $27 to $6,269, With 2 kids, you earn $24 more than with a maximum of $5,572. One child couples can earn a maximum $3,373 which $14 than last year. If you have no kids, then you can only earn $3, which will give you $506.

7) Tax Cuts That Are Sticking Around: Here is some good news, certain tax breaks that were expected to expire are now going to be made permanent. As an example, the Educator Expense Deduction which allows teachers to deduct $250 for classroom supplies that never reimbursed. The IRA charitable transfer clause allows individuals who are at least 70 years old the ability to transfer $100,000 from their IRA to a charity tax-free.

8) The Estate Tax Exemption is Going Up:. The lifetime exemption amount for the gift and estate tax is directly tied to inflation, and it is expected to rise next year. The exemption amount will rise to $5.45 million, which has increased $20,000 from 2015. This limit applies to estates of those who pass away in 2016.

9) Other Tax Provisions could Change if not Renewed: Almost every year, congressman and senators often wait until the last minute to renew important tax breaks such as mortgage insurance deductions, state sales tax deductions, charitable distributions from IRA etc. As of late December some of these provisions had not been renewed for 2015, but Capitol Hill has been known to retroactively renew them in the beginning of the new year. The same could happen in 2016 unless an extension is passed that provides two years of relief instead of only one. Tax bills are still moving through Congress, so stay up to date with any more additional changes that could be made into a bill for new 2016 tax laws.

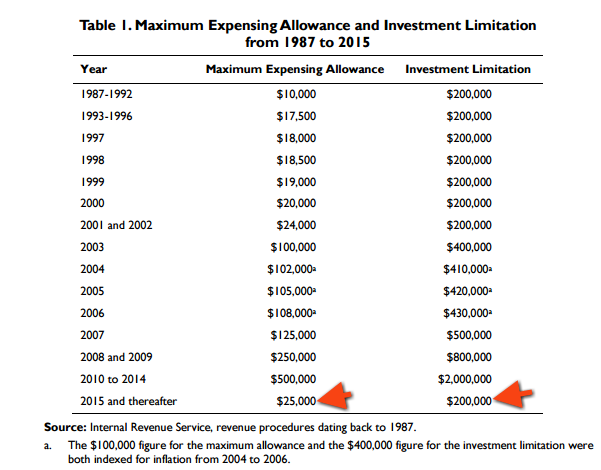

10) Enhancements for Sec. 179 expensing: For tax years beginning in 2014: (1) the dollar limitation on the expensing deduction under Code Sec. 179 was $500,000; and (2) the investment-based reduction in the dollar limitation began to take effect when property placed in service in the tax year exceeded $2 million (the investment ceiling). Under prior law, for tax years beginning after Dec. 31, 2014, the maximum expensing limit was to have dropped to only $25,000, and the investment ceiling was to have dropped to $200,000. Up to $250,000 of qualified real property—qualified leasehold improvement property, qualified restaurant property, and qualified retail improvement property—was eligible for Code Sec. 179 expensing. Under a carryover limitation for qualifying real property, no portion of disallowed expensing because of the active business taxable income limit in Code Sec. 179(b)(3)(A), could be carried for a tax year beginning after 2014.

Under the Path Act legislation, the $500,000 expensing and $ 2 million investment ceiling amount are retroactively extended and made permanent. Additionally, the Path Act makes other Code Sec. 179 changes.

Conclusion

From start-ups to established corporations, businesses rely on accurate and insightful financial information in order to maintain profitability and capitalize on new opportunities. At Scott M. Aber, CPA, CPA, we focus on building close client relationships that add long-term value. Contact us to learn how we help achieve your financial goals.